Q3 Revenue up 30% Year-Over-Year Number of commercial customers increased by 34% to 63 during the first nine months of fiscal 2022

BURNABY, British Columbia & PALO ALTO, Calif. D-Wave Quantum Inc., (NYSE: QBTS) (“D-Wave” or the “Company”) a leader in quantum computing systems, software, and service, and the only provider building both annealing and gate-model quantum computers, today announced financial results for its third quarter ended September 30, 2022.

“Our third quarter results reflect continued progress in our mission to help customers realize real value by using quantum computing for practical business applications, today. The era of commercialized quantum computing is here, and that is evident in the momentum we’re seeing in terms of our expanded customer footprint, accelerated application development, and revenue growth. With a 34% increase in the number of commercial customers year-to-date and a 30% increase in year-over-year quarterly revenue, it’s clear that customers are seeing the impact of our quantum-hybrid solutions in unlocking competitive advantage and fueling growth,” said Alan Baratz, CEO of D-Wave. “In addition, we remain laser focused on relentless product development and delivery. We’re advancing quantum innovation through continued progress on our gate model development efforts, launching solutions that solve important client needs like support for weighted constraints, and furthering the science as shown by our coherent annealing research results, which bring us one step closer to demonstrating practical quantum advantage.”

Recent Commercial / Business Highlights

- Signed a number of new and expanded customer engagements with Forbes Global 2000 companies, as well as industry leaders such as ArcelorMittal, BASF, and Deloitte

- Continued expansion of our commercial customer base with 63 commercial customers in the first nine months of the year, a 34% year-over-year increase

- Worked with customers on a variety of new and expanded quantum hybrid applications; including 3D bin packing, customer offer allocation, employee scheduling, feature selection for machine learning, job shop scheduling, and manufacturing optimization

- Created a new, streamlined pricing structure for our QCaaS offering, shifting from a consumption, time-based approach to a seat-based and application-based collection of offerings designed to better meet the needs of customers and deliver business value

- Launched D-Wave in AWS Marketplace, introducing access to the Leap quantum cloud service and three professional service quantum computing offerings to AWS customers

Recent Technical Highlights

- Continued progress on our gate model development work, reaching several milestones this quarter, including the fabrication of our first gate model qubits in the multilayer stack, the start of benchmarking for one- and two-qubit gates with these devices, and demonstration of a scalable approach to readout for our gate model architecture

- Published research results in Nature Physics that demonstrated large-scale coherence in annealing quantum computers, representing an important step toward practical quantum advantage and providing definitive evidence that D-Wave’s systems perform coherent quantum annealing, which cannot be classically simulated

- Launched an update to the CQM hybrid solver, enabling businesses to run quadratic optimization problems with weighted constraints and benefit from presolve techniques that streamline and simplify problem formulation

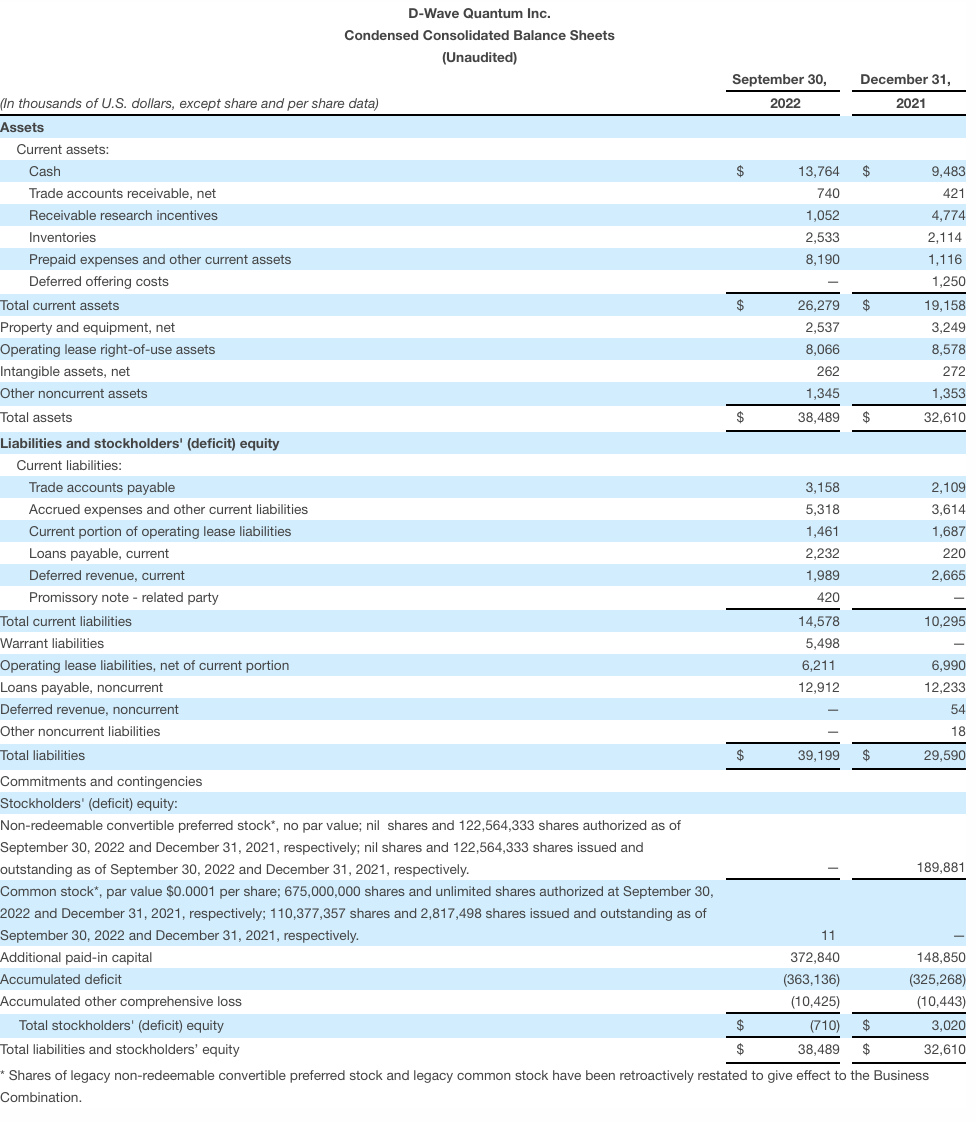

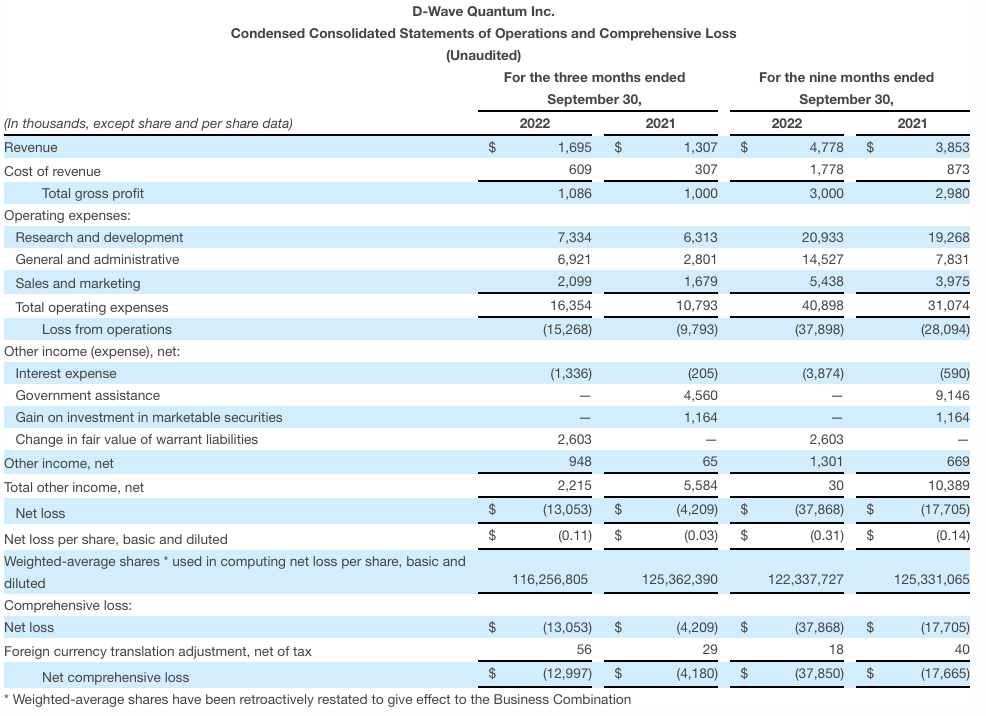

Financial Results for the Third Quarter ended September 30, 2022

- Revenue for the third quarter of fiscal 2022 was $1.7 million, an increase of $388,000, or 30%, from $1.3 million in the third quarter of fiscal 2021 and an increase of $324,000, or 24%, from the immediately prior fiscal 2022 second quarter revenue of $1.4 million

- Gross profit for the third quarter of fiscal 2022 was $1.1 million, an increase of $86,000, or 9%, from $1.0 million in the third quarter of fiscal 2021 and an increase of $301,000, or 38%, from the immediately prior fiscal 2022 second quarter gross profit of $785,000

- Gross margin for the third quarter was 64.1%, a decrease of 12.4% from 76.5% in the third quarter of fiscal 2021 and an increase of 6.8% from the immediately prior fiscal 2022 second quarter gross margin of 57.3%

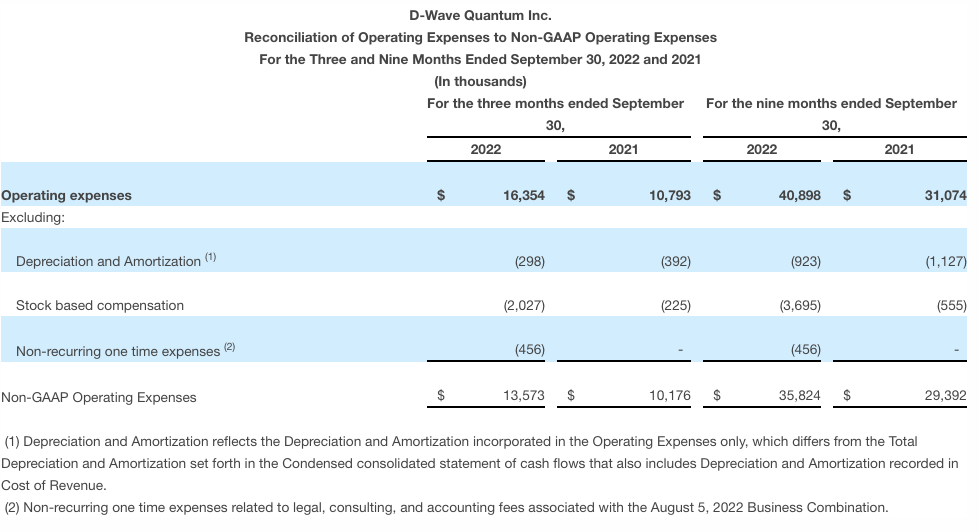

- Operating expenses for the third quarter of fiscal 2022 were $16.4 million, an increase of $5.6 million, or 52%, from $10.8 million in the third quarter of fiscal 2021

- Adjusted operating expenses1 for the third quarter of fiscal 2022 were $13.6 million, an increase of $3.4 million or 33%, from $10.2 million in the third quarter of fiscal 2021

- Net loss for the third quarter of fiscal 2022 was $13.1 million, or $0.11 per share, compared with $4.2 million, or $0.03 per share, in the third quarter of fiscal 2021

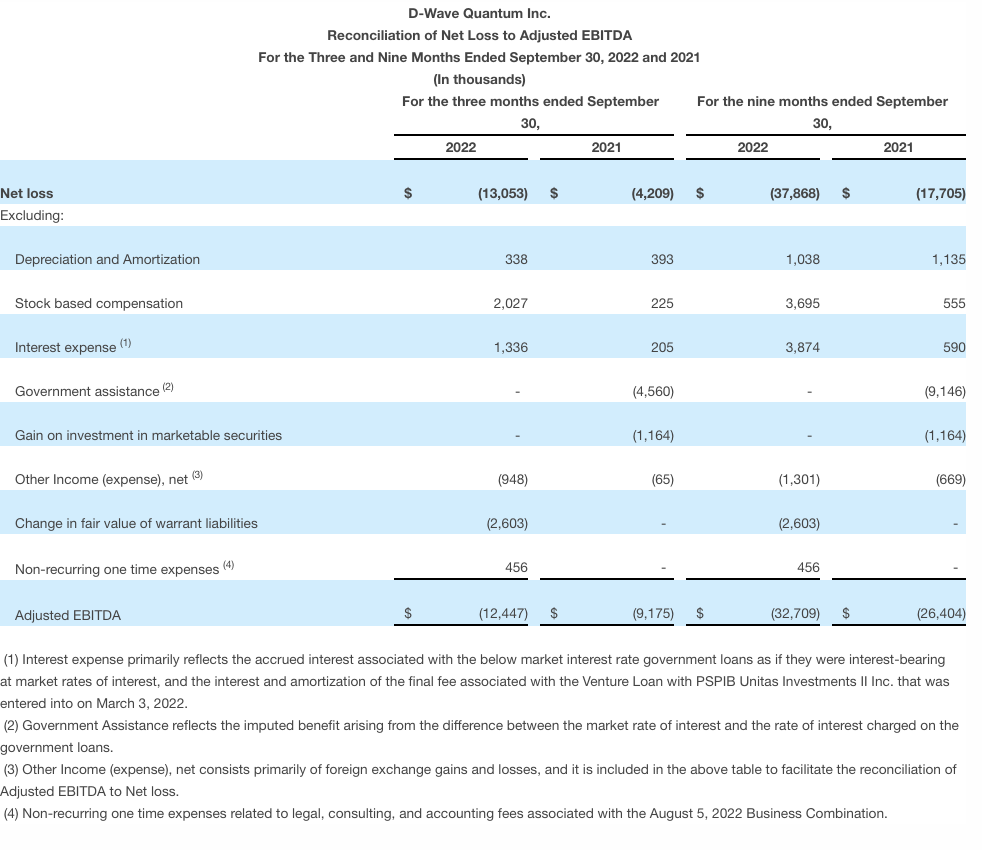

- Adjusted EBITDA2 for the third quarter of fiscal 2022 was negative $12.4 million, a $3.3 million or 36% increase, from negative $9.2 million in the third quarter of fiscal 2021

We are providing adjusted operating expenses and Adjusted EBITDA as we believe these metrics improve investors’ ability to evaluate our underlying performance. Non-GAAP measures do not have any standardized meaning under GAAP, and therefore may not be comparable to similar measures employed by other companies.

- Adjusted operating expenses is a non-GAAP financial measure. For a description of adjusted operating expenses and a reconciliation to operating expenses, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release.

- Adjusted EBITDA is a non-GAAP financial measure. For a description of Adjusted EBITDA and a reconciliation to net loss, the closest comparable GAAP financial measure, refer to “Non-GAAP Financial Measures” below and the reconciliation table at the end of this release

Financial Results for the Nine Months of Fiscal Year 2022

- Revenue for the nine months ended September 30, 2022, was $4.8 million, an increase of $925,000, or 24%, from $3.9 million in the nine months ended September 30, 2021

- During the nine months ended September 30, 2022, D-Wave had 63 commercial customers, an increase of 16, or 34%, from 47 commercial customers in the nine months ended September 30, 2021

- During the nine months ended September 30, 2022, D-Wave had 105 total customers, an increase of 24, or 30%, from 81 total customers in the nine months ended September 30, 2021

- Gross profit for the nine months ended September 30, 2022, was $3 million, a small increase from $2,980,000 in the nine months ended September 30, 2021

- Operating expenses for the nine months ended September 30, 2022 were $40.9 million, an increase of $9.8 million, or 32%, from $31.1 million in the nine months ended September 30, 2021

- Adjusted operating expenses for the nine months ended September 30, 2022 were $35.8 million, an increase of $6.4 million, or 22%, from $29.4 million in the nine months ended September 30, 2021

- Net loss for the nine months ended September 30, 2022, was $ 37.9 million, or $0.31 per share, compared with $17.7 million, or $0.14 per share, in the nine months ended September 30, 2021

- Adjusted EBITDA for the nine months ended September 30, 2022 was negative $32.7 million, an increase of $6.3 million, or 24%, from negative $26.4 million for the nine months ended September 30, 2021

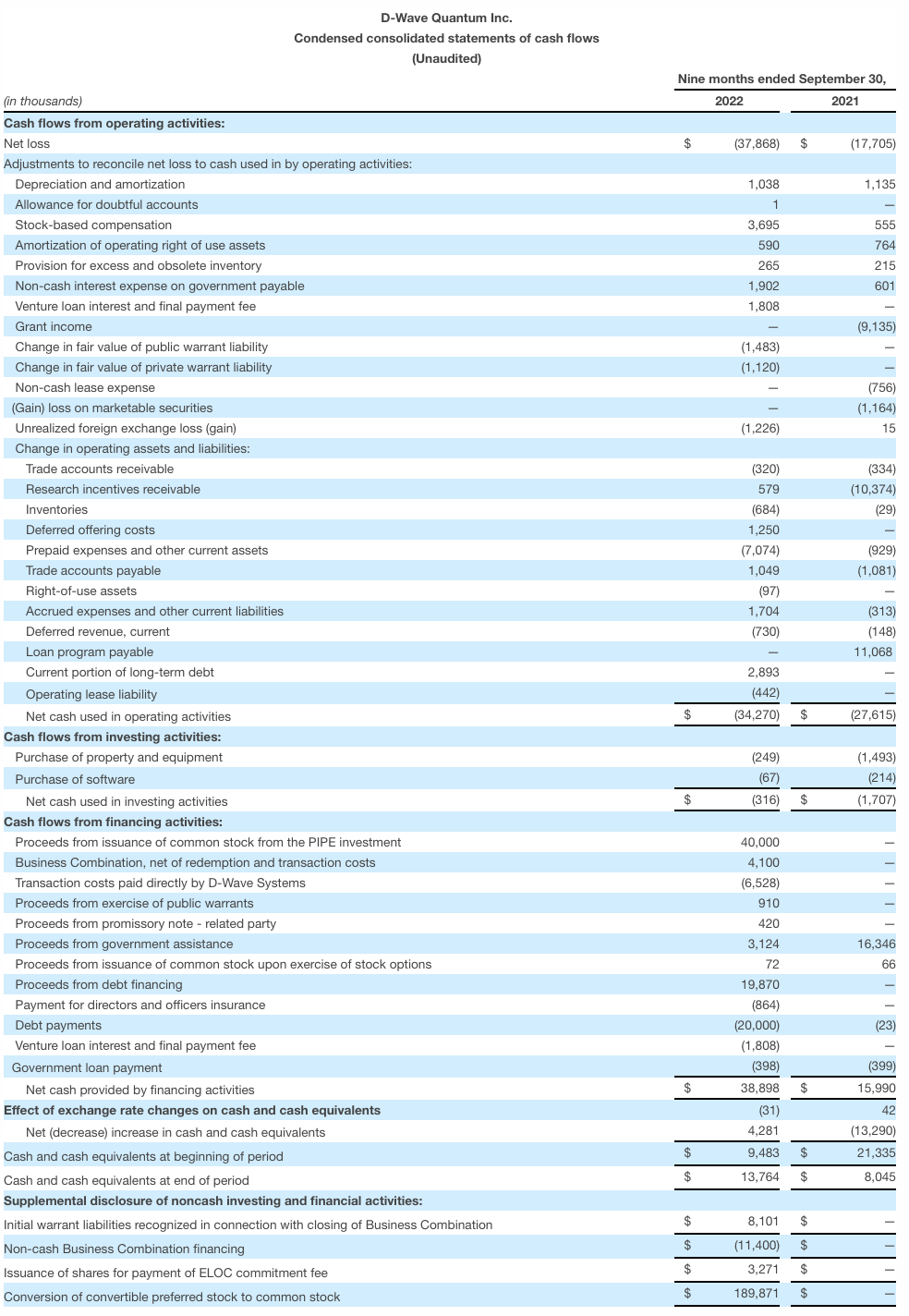

Committed Equity Facility

As previously disclosed, on June 16, 2022, D-Wave entered into a common stock purchase agreement with Lincoln Park Capital Fund, LLC (“Lincoln Park”). Under the agreement, the Company has the right, but not the obligation, to issue and sell up to $150 million of shares of its common stock to Lincoln Park, subject to certain limitations and satisfaction of certain conditions, over a 3-year period. Further details have been provided in the Company’s related Form S-1 Registration Statement and in the Company’s Form 10-Q for the quarter ended September 30, 2022, each filed with the Securities and Exchange Commission.

Fiscal Year 2022 Outlook

Based on information available as of November 10, 2022, D-Wave is maintaining its fiscal 2022 Revenue and Adjusted EBITDA guidance as follows:

- Revenue is expected to be in the range of $7.0 million to $9.0 million

- Adjusted EBITDA is expected to be less than negative $49 million1

- We are not able to reconcile guidance for Adjusted EBITDA to its most directly comparable GAAP measure, net loss, and cannot provide an estimated range of net loss for such period without unreasonable efforts because certain items that impact net loss, including foreign exchange and stock-based compensation, are not within our control or cannot be reasonably predicted.

Third Quarter 2022 Conference Call

In conjunction with this announcement, D-Wave will host a conference call on Thursday, November 10, 2022, at 8:00 a.m. (Eastern Time), to discuss such financial results and its business outlook. The live dial-in number is 1-877-300-8521 (domestic) or 1-412-317-6026 (international), conference ID code 10171956. A live webcast and subsequent replay of the call will also be available on the “Investors” page of the Company’s website at: http://ir.dwavesys.com/.

About D-Wave Quantum Inc.

D-Wave is a leader in the development and delivery of quantum computing systems, software, and services, and is the world’s first commercial supplier of quantum computers—and the only company building both annealing quantum computers and gate-model quantum computers. Our mission is to unlock the power of quantum computing today to benefit business and society. We do this by delivering customer value with practical quantum applications for problems as diverse as logistics, artificial intelligence, materials sciences, drug discovery, scheduling, cybersecurity, fault detection, and financial modeling. D-Wave’s technology is being used by some of the world’s most advanced organizations, including NEC Corporation, Volkswagen, DENSO, Lockheed Martin, Forschungszentrum Jülich, University of Southern California, and Los Alamos National Laboratory.

Non-GAAP Financial Measures

To supplement the financial information presented in accordance with GAAP, we use non-GAAP measures of certain components of financial performance. Each of Adjusted EBITDA and adjusted operating expenses is a financial measure that is not required by or presented in accordance with GAAP. Management believes that this measure provides investors an additional meaningful method to evaluate certain aspects of such results period over period. Adjusted EBITDA is defined as net loss before interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation, remeasurements of liability-classified warrants, and other nonrecurring nonoperating income and expenses. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. Adjusted operating expenses is defined as operating expenses before depreciation and amortization expense and stock-based compensation expense. We use adjusted operating expenses to measure our operating expenses, excluding items we do not believe directly reflect our core operations. The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the financial results prepared in accordance with GAAP, and our presentation of non-GAAP measures may be different from non-GAAP measures used by other companies. For a reconciliation of each of Adjusted EBITDA and adjusted operating expenses to its most directly comparable GAAP measure, please refer to the reconciliations below.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which statements are based on beliefs and assumptions and on information currently available. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties, and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. We caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, which are subject to a number of risks. Forward-looking statements in this press release include, but are not limited to, statements regarding the company’s future growth and innovations; the increased adoption of quantum computing solutions and expansion of related market opportunities and use cases and our customer base; and our expectations relating to revenue and Adjusted EBITDA for fiscal 2022. We cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward-looking statements are subject to a number of risks and uncertainties, including, among others, various factors beyond management’s control, including general economic conditions and other risks, our ability to expand our customer base and the customer adoption of our solutions, and the uncertainties and factors set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the registration statement on Form S-1 (SEC File No. 333-267124), initially filed by the Company with the SEC on August 29, 2022 and which was declared effective by the SEC on October 26, 2022, as well as factors associated with companies, such as D-Wave, that are engaged in the business of quantum computing, including anticipated trends, growth rates, and challenges in those businesses and in the markets in which they operate; the outcome of any legal proceedings that may be instituted against us; risks related to the performance of our business and the timing of expected business or financial milestones; unanticipated technological or project development challenges, including with respect to the cost and or timing thereof; the performance of the our products; the effects of competition on our business; the risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all; the risk that we may never achieve or sustain profitability; the risk that we are unable to secure or protect our intellectual property; volatility in the price of our securities; and the risk that our securities will not maintain the listing on the NYSE. Furthermore, if the forward-looking statements contained in this press release prove to be inaccurate, the inaccuracy may be material. In addition, you are cautioned that past performance may not be indicative of future results. In light of the significant uncertainties in these forward-looking statements, you should not place undue reliance on these statements in making an investment decision or regard these statements as a representation or warranty by any person we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

Contacts

Investor Contact:

Kevin Hunt

ir@dwavesys.com

Media Contact:

Jill Wroblewski

AxiCom

media@dwavesys.com